Case Study: Boosting Profits and Safety by Eliminating Overpouring

(4th in the "It’s Not Magic, It’s Math" series)

Short on Time? Skip to the Recap Below!

The Problem: Overpouring Costs

In December 2013, after secret shopper visits revealed a client’s bartenders were significantly overpouring spirits, I was hired to conduct a best bar practices workshop. In the workshop, I shared with his bar staff how my OPulator (Over Pouring Calculator—an Excel spreadsheet populated with simple algorithms that used client sales information and secret shopper findings) guesstimated the client might increase monthly profits by $11,000 if overpouring was eliminated. The gathered bartenders also heard how the increased profits would be a result of a reduction in the cost of goods purchased and a bump in sales since some customers would order another drink once overpoured drinks were eliminated—meaning the bartenders would also make more in tips (as would the servers).

The Results: Increased Profitability

In January 2015, the client (the business owner) called me for help. He had submitted the needed business records to his tax attorney for filing his return, but his attorney was uncomfortable. The attorney couldn’t understand how the client purchased noticeably fewer spirits from vendors but sold significantly more spirits to his customers. Naturally, I agreed to help. The client emailed to connect me to his tax attorney.

That was followed by me emailing the tax attorney (Vicki) some training information, and then a 40-minute phone conversation. It turns out the client made a bit over $10,000 more profit a month after his bartenders eliminated overpouring. Once I shared information about the spotter reports and the OPulator, Vicki was satisfied and impressed, declaring everyone needed to do this! Yep.

The Broader Impact: Enhanced Public Safety

Years later, Lauren and I were meeting with Riverside Sheriffs. We were recommending the bar best practices workshop for their businesses. An officer asked, “How do you know the training improves public safety?” Fair question.

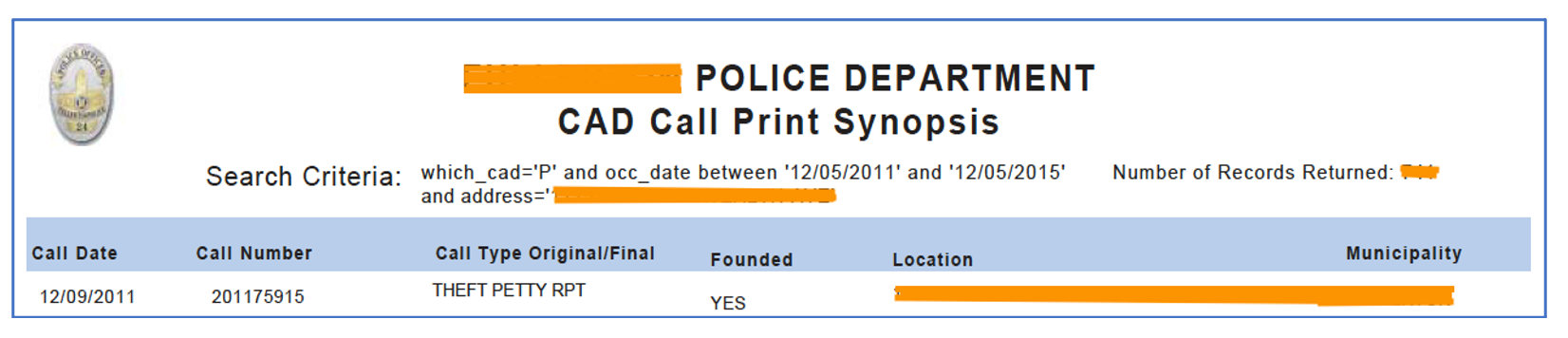

I did a public records request for the $10,000 more profit a month business, seeking calls for service records for the two years prior to my best bar practices workshop and the two years after the workshop.

In the two years following the best bar practices workshop, the business’s call for service dropped by 25%.

Years later, I came across a bulletin from Partners Specialty Insurance that stated bars with strict pouring controls experience around half the number of insurance claims compared to bars that do not have strict pouring controls.

It’s very simple: customers who are less intoxicated are less likely to start a fight or create an incident that results in a call for service and an insurance claim.

It’s not magic, it’s math.

Upcoming in the It’s Not Magic, It’s Math series:

- My $14,000,000 Mistake

- The People Behind the Numbers